How to Create Your Own Whole Life Insurance Policy

You probably need life insurance if you:

- Are the primary breadwinner and need protection for your family against the loss of your income

- Have family members who would be responsible for your debts

- Have expenses that you need or would like for your estate to cover (examples: estate taxes, funeral costs, unique costs like children’s or grandchildren’s schooling, etc…)

- Have debts that would eat up assets you would like to pass on to family or loved ones

The type of life insurance you buy is contingent on your particular circumstances and needs. That being said, most people only need a term life insurance policy to cover the loss of their income during a specific period of their life (generally 20 or 30 years). Whole life insurance makes the most sense for large estates looking to transfer wealth to the next generation and/or cover liquidity needs (estate taxes) after death.

Still, the idea of whole life insurance sounds appealing, since permanent money sounds better than money only during a specific time period. The good news is – we can create a whole insurance policy ourselves! Let’s take a look at how to accomplish this.

Creating and Maintaining Your Policy

Let’s use our pal Jane as an example. Jane is a 35-year-old non-smoking woman who is generally in good health. Jane was widowed last year and has two young children. Jane speaks to her life insurance agent to get a quote on 2 different policies:

Instead of having to choose between these two policies, Jane could create her own whole life insurance policy. To do this she would buy the 30-year term life insurance and invest the difference between the premiums ($850 monthly) in a brokerage account. This would essentially unbundle what the insurance company is doing with their whole life product.

Here is where things get cool! In a permanent policy, the insurance company takes your monthly premiums and invests them according to the firm’s set asset allocation. They only give you access to a certain amount of money in the policy known as the cash value. Typically, it takes about three years to become positive and over 10 years to break even. You are “underwater” on this policy for the first 10 years of owning it. In Jane’s homemade whole life insurance policy, she has access to her cash value on day one. Granted, if she dips into the cash value, she will not meet her long-term goals. But, if there is an emergency, she will have access to her funds. She will not be faced with fees from an insurance company. Most importantly, she will not surrender the policy and lose much or all that she paid in after months of premiums.

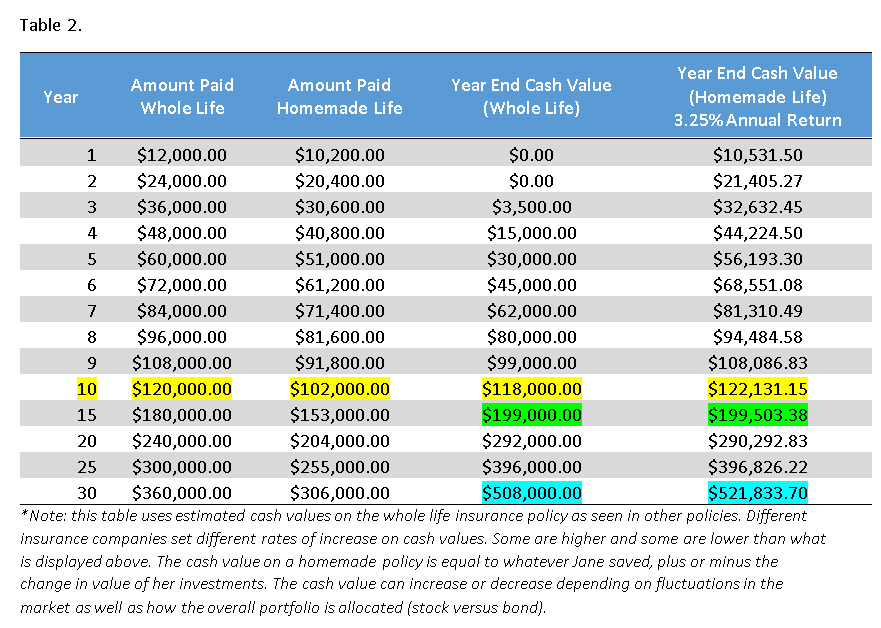

Table 2 shows how the cash value typically grows on a whole life policy versus Jane’s very conservative homemade policy, assuming Jane invests 100% in high quality municipal bonds local to her state, thereby generating a 3.25% annual after tax return:

As you can see above, Jane does not break even on her whole life policy until after year 10 (as highlighted in yellow). In year 15 the whole life policy nearly matches the value of the homemade one, highlighted in green, after Jane has paid $180,000 in premiums. The highlights in blue show the cash value of the policy after the end of the 30-year term policy. The value of the homemade policy on an after tax basis is higher than that of the fixed whole life contract. Better yet – Jane is able to do this by only investing in a 100% municipal bond portfolio!

The next table compares Jane’s whole life insurance policy with a homemade one invested in a 50/50 mix of global stocks and municipal bonds generating a long run return of 6%:

You’ll notice above that at no point does Jane’s whole life contract outperform her homemade policy. By including stocks in her portfolio, Jane increased the cumulative value of her account by $347,000 (68%) over the life of her 30-year term policy!

The commitment of creating a homemade whole life policy sets a 30-year time horizon on Jane’s investments. The time horizon plays an important role in setting the asset allocation and liquidity needs of an investment portfolio. Generally, horizons of greater than 15 years are considered long term, thereby allowing for an increase in risk assets (stocks). This is because there is abundant amount of time for the asset class to achieve its long term return objectives. Jane’s stage of life also plays an important role. As Jane is a young investor looking to commit capital to long term savings over a 30-year time horizon, she would be considered an aggressive investor. Likely, the 50/50 portfolio of stocks and bonds would be too conservative for her needs, in which case the cash value on the homemade policy would grow to be much larger than shown above. ($1.25MM investing in an aggressive portfolio generating 8%, $1.85MM investing in a very aggressive portfolio generating 10%).

Using Your Cash Value

Life insurance agents like to point out the biggest selling point of whole life contracts: taking loans against cash values to create streams of tax-free income during your life. Here’s the thing about buying insurance – generally, you don’t get to enjoy it during yourlifetime because you have to die to get the payout. Permanent life solves that problem by allowing you to draw against the cash value of your policy. Due to the current tax laws, you can do this in a tax free manner, provided you only withdraw up to the principal paid into the contract and then take loans on any remaining cash values.

Let’s take a look at borrowing with our friend Jane’s homemade policy.

Jane decided to invest in the 50/50 portfolio of stocks and bonds. She is now 65. Her term policy is at its end and her homemade life account has $850,000 in it. Jane can do a few things with this money. If Jane uses the safe withdrawal rate of 4% to determine how much she will withdraw from her portfolio, she can use $34,000 per year. She can also decide only to live off the yield of the portfolio (dividends and interest). Lastly, she can choose to do nothing because she will have to pay long-term capital gains taxes. Instead, she can borrow against the securities in her account, just like a whole life contract.

Brokerage houses have something called collateralized lending. This means Jane can borrow money against her portfolio of stocks and bonds to create cash flows, rather than selling assets in her portfolio. Generally, diversified stock investments (like the ones Jane has made) get 70% lending value while the bonds in her portfolio will get 90%, for a total of 80% lending value on a 50/50 portfolio. This means that Jane can borrow up to $680,000 against her portfolio (when she is 65, this number will increase as she stays invested throughout her life). If Jane had a whole life policy, she would have a comparable loan ratio of 78%. Similar to whole life insurance, if Jane dies while having an outstanding loan, the value of her estate or policy will be reduced by the amount of the outstanding loan before being passed along to her beneficiaries.

Jane can use a loan to fund many of the things whole life contracts promise – for instance accelerated benefits. Accelerated benefits are when a life insurance company gives a contract holder access to a certain percentage, usually 70%, of their death benefit due to illness (as defined by long term care standards, not a common cold). There are term life insurance policies that offer accelerated benefits for an additional cost, known as a rider. If Jane were to add this rider to her term policy, she would be covered during the initial 30-year period while she allowed her portfolio to increase in value and she can borrow against the value of her account in times of need later in her life. Additionally, she could buy long term care insurance after the end of the term if she were worried about not having the funds to provide for herself during sickness.

Like Jane, you too can create your own whole life insurance policy! While there are many ways to achieve financial independence, whether it be to buy whole life policies or to invest in the market, it’s important to note the differences between the two. The time horizon on a whole life contract is your entire life. You as the investor can bear more risk over the time period than the contract will allow. By buying term life and investing in an appropriate mix of stocks and bonds, you will undeniably outperform a fixed whole life contract over its life. The trick is to stick to a strategy and reap the benefits that come with long term investing.

Disclosures: This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. It is important to understand investing in general involves risk of loss that you should be prepared to bear. Please refer to our Firm’s Form ADV Part 2 Disclosure Brochure for more information regarding the risks of the investments held in your account. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm's investment advisory services.