China and Other Stories

August has been a particularly nasty month for risk assets.  This period appears to be more serious than the brief market correction we saw last October. News of problems in China, particularly of a shrinking in their manufacturing sector has caused investors to indiscriminately sell equities, purchase government bonds, and raise cash in money market accounts. Markets seem to decline quickly in recent years only to bounce back nearly as swiftly. Corrections have been short-lived non-events since 2011. Despite being in a bull market, in recent years the VIX (measure of market volatility) has seen shocking intraday rises. On Friday August 21st, the VIX spiked 46%. To put this into perspective, the VIX only spiked 23% on September 15th, 2008, when Lehman Brothers filed for bankruptcy. It seems that market participants are very quick to anticipate the worst and are willing to pay for protection at any cost.

China in a Bear Shop?

This period appears to be more serious than the brief market correction we saw last October. News of problems in China, particularly of a shrinking in their manufacturing sector has caused investors to indiscriminately sell equities, purchase government bonds, and raise cash in money market accounts. Markets seem to decline quickly in recent years only to bounce back nearly as swiftly. Corrections have been short-lived non-events since 2011. Despite being in a bull market, in recent years the VIX (measure of market volatility) has seen shocking intraday rises. On Friday August 21st, the VIX spiked 46%. To put this into perspective, the VIX only spiked 23% on September 15th, 2008, when Lehman Brothers filed for bankruptcy. It seems that market participants are very quick to anticipate the worst and are willing to pay for protection at any cost.

China in a Bear Shop?

The media has sensationalized the situation going on in China. The issue at hand is not if China is slowing. China is slowing and has to slow. In the past two decades, China’s growth has been astoundingly high:

- About 30% of all global growth in 2013 and 2014 came from China

- In 2014, China was the 2nd largest economy in the world, with a GDP per capita of $7,595

- to put in perspective, GDP per capita in the US in 2014 was $54,630

- Further perspective on growth, twenty years ago, China was the 8th largest economy with GDP per capital of $472

- 1994 US GDP per capital was $27,775

The type of growth we have seen in the last 20 years is unfortunately not sustainable. The Chinese government claims that its country can still grow 7% on a real basis and will do so for the next 5 years. This however, is highly unlikely. Where Can China Accelerate Growth? There are various pieces of China that drive growth: exports, investments and consumer demand.

- Exports

- China is already the largest exporting country.

- This makes it difficult for them to continue growing share in a meaningful way

- Investments

- Investments have been an overwhelming driver of growth in past years.

- Further investment may prove difficult.

- China leads the way with investments in infrastructure.

- Though much has been built, infrastructure investment is still a priority for the government.

- Infrastructure has been a means to combat flagging economic growth.

- There are signs of overbuilding as well as a possible real estate bubble in China.

- Industrial investments are unlikely with the numbers showing overcapacity.

- Consumer Demand

- Growth can come from China’s household sector.

- Household savings rates are high with room to come down.

- Household consumption is only 35% of GDP.

- Chinese population growth is still on the rise and is calculated to peak in 15 years.

- If China can make use of their investments, it will allow their population to prosper.

- While we will not see 7% growth, it will allow for a sustainable 5% growth in the future.

It’s true that many of the statistics we use to track Chinese growth come from the Chinese government and thus we may question reliability. However, there are both good and bad realities that we cannot ignore:

The growth story in China is real. It’s more than the physical infrastructure that has been built up in China over the last few decades. Many of its population is prospering. Chinese citizens are able to afford more and there is a huge demand for goods and services. The country’s working age population is nearly 1 billion people, all of whom need homes, clothing, shoes, food, appliances for their homes, cell phones, etc… More Chinese are travelling and starting to spend money abroad, albeit a small percentage of their population. While their population is starting to age, their resulting ability to grow at a reasonable rate will not be hampered for quite some time.

Owning assets without China risk is a near impossibility. Nearly every large company in the US has a China strategy. Many multinational corporations depend on both China and the rest of the emerging markets for their growth. For instance, Apple currently derives 30% of all its revenue from Asia, with 15% of its total revenue coming from China alone. China also owns $1.2 trillion (8%) of all publicly held US debt, the third largest holder behind the Social Security Trust Fund ($3 trillion) and the Federal Reserve ($2 trillion from quantitative easing purchases). While the bulk of US debt is still held by Americans and the government, US treasuries could be affected by a China crisis, if China needed to dump reserves onto the market. A portfolio of assets without China risk would only include micro and small cap US equities who only obtain revenues from the Americas. Still, this portfolio would be correlated to the overall market and thus be affected by a downturn.

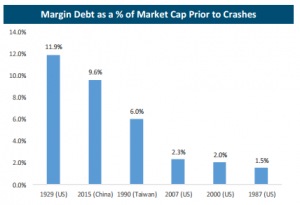

Chinese margin debt is largely a cause of the crash. To the right is a graph of margin debt  compared to other large crashes in the history of the markets. You will notice the comparison between what happened in the US in 1929 versus what is happening in China now. Using leverage to purchase risky assets has never been good idea. Our country learned this lesson and so will China. While margin debt is on the decline, there is still a great deal of debt outstanding. This can unfortunately affect future turbulence in the global markets.

compared to other large crashes in the history of the markets. You will notice the comparison between what happened in the US in 1929 versus what is happening in China now. Using leverage to purchase risky assets has never been good idea. Our country learned this lesson and so will China. While margin debt is on the decline, there is still a great deal of debt outstanding. This can unfortunately affect future turbulence in the global markets.

What effect will margin calls have on the Chinese population? Currently, 80% of Chinese shares are held by retail investors. However, less than 7% of Chinese citizens own stocks. 20% of Chinese household wealth is tied up in Chinese markets, mostly held in fixed income and bank deposits. In summary, this can only affect the consumer growth story in China if the population that owns equity is a large proportion of consumer spending.

Chinese corporate governance is a huge problem. China has moved to adopt international accounting standards, however companies still hold back key information from investors. Nearly 10% of all securities class action litigation in the US (from 2009-2013) is against Chinese companies listed in the US. In the accounting of variable interest entities (VIEs), some Chinese companies have reported assets and related income on their balance sheets and income statements for companies they do not actually own. This is in stark contrast to how Enron used their VIEs to hide liabilities. Notably, if some earnings are being overreported, this could mean that Chinese companies are more overvalued than the market realizes. Looking at China versus the rest of the world, even after the decline in prices, it is still one of the most expensive places to be. Price to earnings ratios are higher, price to book values are higher and enterprise value to EBITDA values are higher than companies of other regions. However, average return on invested capital is no higher than the rest of the world, meaning these companies aren’t producing higher rates of return that would justify higher multiples.

Markets have climbed quite a bit since the low of March 2009. At some point we will see a 20% decline in the equity markets. Those who panicked will at one point be right. But at what cost? This type of behavior often creates significant opportunity. It is possible that we are in for a wild ride in equities and that we will experience heightened volatility over the next few months. However, this does not change our strategy. We are long term investors. Like the famous words of Warren Buffett, “Our preferred holding period is forever”. While ours may not be forever (our lifespans forbid it), it can surely be longer than a few months of volatility!

Sources: GDP per Capita data from the World Bank; US Debt data from treasury.gov; Chinese corporate governance data from an MIT Study on Chinese Accounting Fraud and Paul Gillis’ VIE Study in the Journal of Applied Corporate Finance; Margin Debt data from Guggenheim, Bloomberg (data as of July 31st 2015)

Disclosures:

This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. It is important to understand investing in general involves risk of loss that you should be prepared to bear. Please refer to our Firm’s Form ADV Part 2 Disclosure Brochure for more information regarding the risks of the investments held in your account. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm's investment advisory services.