Unable to Diversify? This is for you!

Sometimes, a person finds themselves with a concentrated portfolio of assets rather than a diversified one. A common reason is many highly paid employees receive stock as part of their compensation package. Stock and stock bonuses also help companies retain employees due to vesting schedules and delayed bonus payments. As a result, business owners or employees own concentrated portfolios of single assets. Due to loyalty to the company, passion for the mission, tax consequences, or momentum, they continue to own single assets as most or a large part of their investable savings.

Concentrated investments pose problems from a planning perspective. Your ability to retire, spend portions of your portfolio on large future expenses, or simply understand your financial future, is highly dependent on the performance of a single asset. As a result, planners like myself, often tout diversification as a good solution. And it IS a good solution. However, sometimes there are practical reasons why you may not or cannot diversify:

You are an officer at a company, and you cannot sell large amounts of stock without the public raising an eyebrow

It is not the right year to incur severe tax consequences from diversification (like an uncharacteristically high income year)

You have a very high conviction on your holding and can afford to take the risk

The Trinity study is a highly influential financial paper, discussing how to distribute assets from your portfolio without depleting the funds over long time horizon. Here’s how the study works:

The Trinity Study has some practical issues

It assumes you hold a 50% diversified stock and 50% diversified bond portfolio

Data was calculated during the biggest bond boom and rate decline

Does not apply to portfolios of concentrated assets

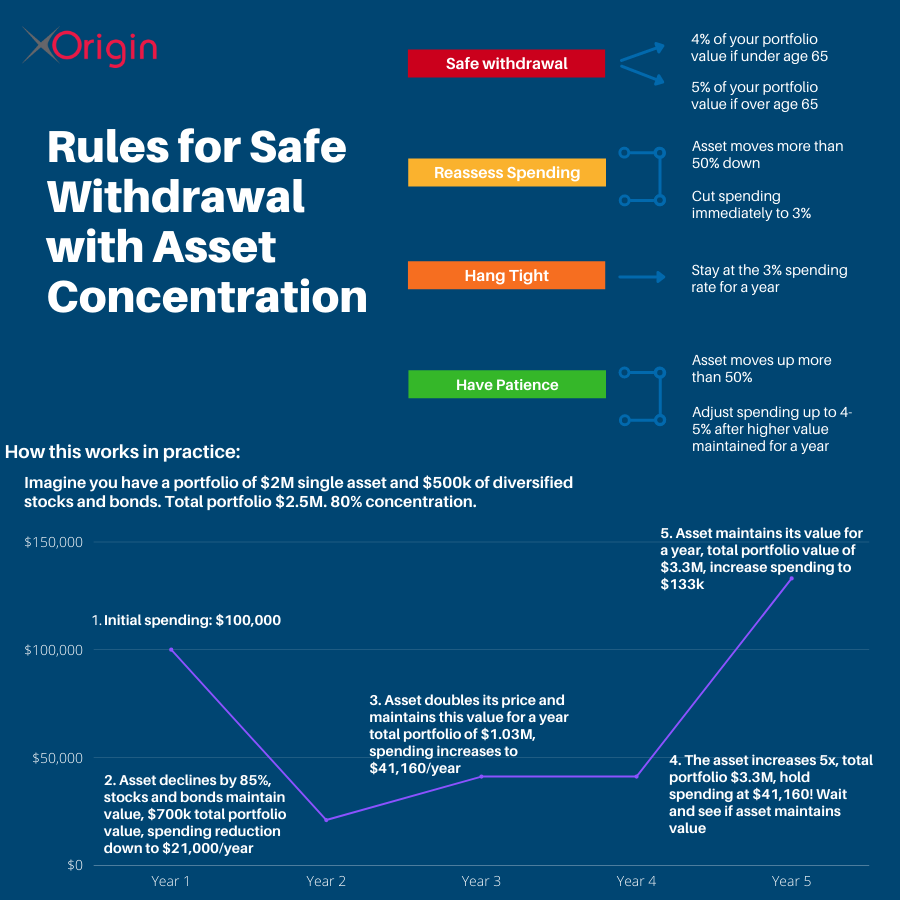

Assessing how much money you can theoretically live on, with a concentrated portfolio, is not often addressed. If you find yourself practically unable to diversify, consider the following rules for safe withdrawal:

Some notes to think about:

Owning a concentrated volatile asset means large changes in spending year to year. Do not commit to high fixed expenses (mansion, private jet, etc...) unless you have other income.

The bigger your portfolio, the easier it will be to do this strategy. Meaning, if I 10xed all these numbers, spending within limits becomes a lot easier!

Adjust spending down to pay capital gains taxes and/or taxes on qualified dividends.

Some years expenses will increase, (due to inflation) more than the portfolio, (due to concentration).

You will have more predictable spending by owning a diversified portfolio.

Are you in this situation? Let's discuss!